Discusses the Chair’s departure, short-seller attack on the company and other recent news

Lightwave Logic’s Chairman Resigns

Development stage electro-optic polymer company Lightwave Logic (NASDAQ:LWLG) was put back under the spotlight last week after reporting in an 8K filing, the firm’s Chairman of the Board, Thomas Zelibor had tendered a letter of resignation.

Q2 2022 hedge fund letters, conferences and more

In the filing, Lightwave noted that Zelibors resignation was not a result of any disagreement between himself and the company.

Thomas is poised to step down from the leadership position on the 1st of October after a stint with the company spanning back to 2008.

Despite the resignation, Lightwave was able to secure Zelibor as an advisor to CEO Michael Lebby until the end of 2022, to assist with an orderly transition.

In lieu of Zelibors departure, the Board elected CEO Michael Lebby as Chairman but noted he will not receive any additional financial compensation for his time serving in the additional role.

LWLG’s share price has continued to tumble since the release of the news, slipping more than -22%. The stock was already retreating from quarterly highs above $12, but the selling intensified following the release.

Q2 Earnings

Earlier in August, Lightwave released second quarter earnings with the company posting a Net Loss of -$3.8 million compared to a Net Loss of -$4.5 million in the prior year.

The company also ended the quarter with $24.8 million in cash and cash equivalents which should keep operating expenses covered for at least the next year at a minimum.

The last time Lightwave grabbed headlines was back in early June, when the firm’s stock began to spiral lower after coming under attack by short-seller Kerrisdale Capital.

Kerrisdale in the report lashed out at the company, claiming that they had been in the “development stage” for more than 30 years.

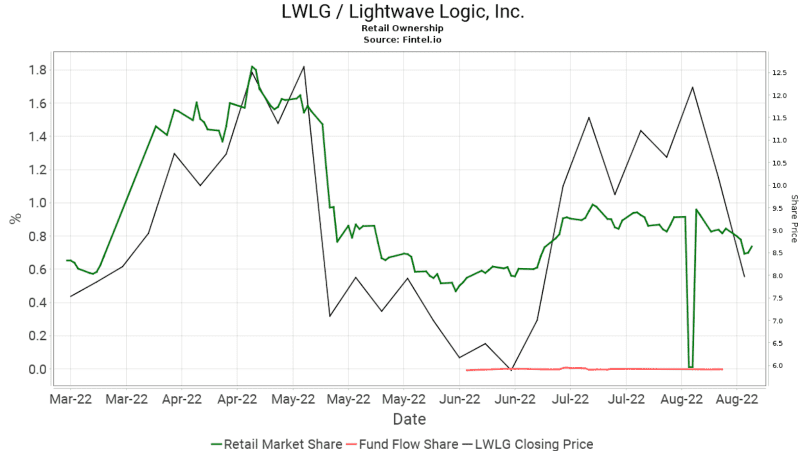

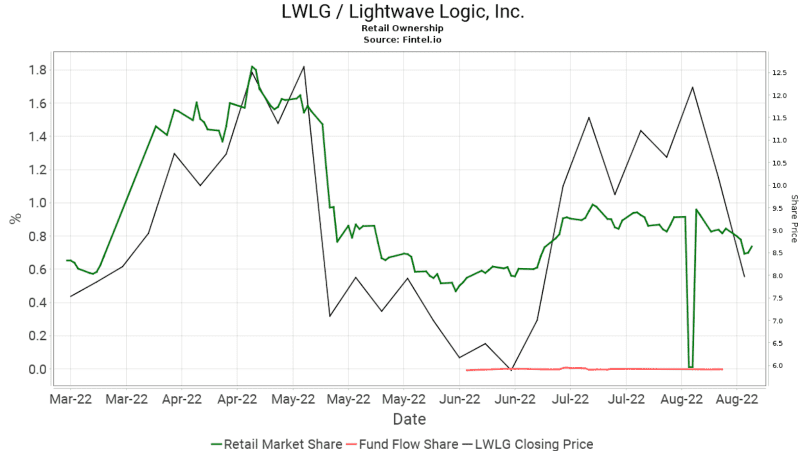

The short attack was picked up by retail investors across the Reddit platform, sparking a sharp rise in buying activity. This is seen on the retail market share vs stock price chart provided to the right.

LWLG this week has fallen 2 ranks is currently the 9th most held security by retail investors who have linked their portfolio for free with the Fintel platform.

In addition to this, institutional ownership has been noticed growing at an increased rate over 2022. While fintels ownership accumulation score of 42.43 is bearish, the company has 178 institutions on the register that own a total of 25.9 million shares on the register.

Some of these institutions include Geode Capital, Charles Schwab and 272 Capital LP.

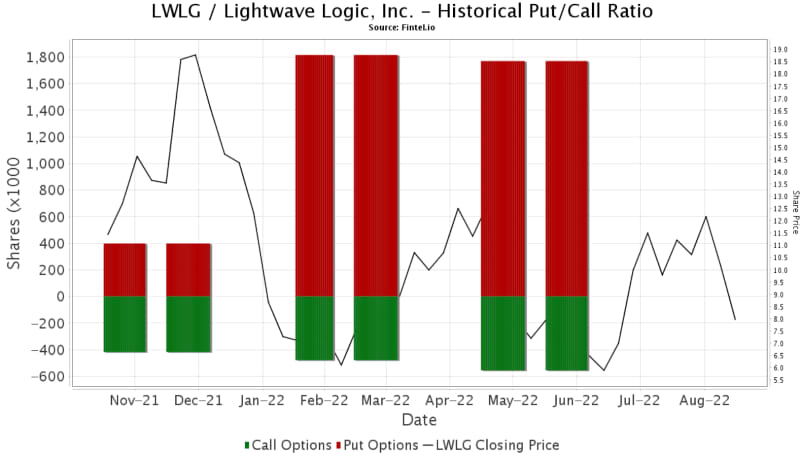

Sentiment across these institutions has been relatively bearish over the last year with the level of put options significantly outweighing call options. This is displayed in the chart below.

Article by Ben Ward, Fintel