What’s New In Activism – Six Flags Entertainment Surge

Six Flags Entertainment Corp (NYSE:SIX) shares surged 16% last Thursday after the amusement park company said it had permitted H Partners to buy up to 19.9% of its share capital.

The new threshold is a step-up from the previous limit of 14.9% – included in a January 2020 deal that also gave Arik Ruchim, a partner at the activist firm, a seat on Six Flags’ board.

Q3 2022 hedge fund letters, conferences and more

"H Partners has been a constructive and important partner to the company. We are pleased they continue to recognize the value potential of Six Flags," commented Chairman Ben Baldanza.

H Partners' Ruchim praised Six Flags and said his firm was "excited" about the company's strategy to drive "sustainable, long-term earnings growth."

Activism chart of the week

So far this year (as of November 10, 2022), 28 Australia-based companies have been publicly subjected to a remove personnel-related demand. That is compared to 17 in the same period last year.

Source: Insightia |Activism

What’s New In Proxy Voting - Indigenous Peoples' Rights

Members of the Investor Advocates for Social Justice refiled proposals calling on Wells Fargo and Citigroup to enhance reporting related to human rights standards for Indigenous Peoples.

The proponents highlighted that both Citigroup and Wells Fargo have a "history of financing projects and companies that violate Indigenous rights", most notably as lead financiers of the Dakota Access and Enbridge Line Three pipelines.

Similar proposals won 34% and 25.9% support, respectively, at the banks' 2022 annual meetings, according to Insightia's Voting module.

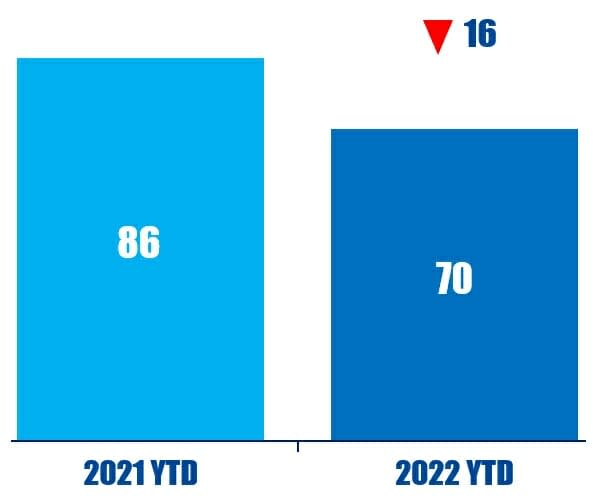

Voting chart of the week

So far this year (as of November 14, 2022), 70 U.K. directors have received opposition of 20% or more to their elections. This is down from 86 over the same period last year.

Source: Insightia |Voting

What’s New In Activist Shorts - TuSimple

Xiaodi Hou, the co-founder of Tusimple Holdings Inc (NASDAQ:TSP) who was recently deposed as CEO, teamed up with another top holder to oust the self-driving trucking company's board. Short seller Grizzly Research targeted TuSimple last year over its leadership team.

Four TuSimple independent directors have been removed, with co-founder and major shareholder Mo Chen named executive chairman and Cheng Lu returning to the CEO role, the company said in a filing last Thursday.

Last year in August, Grizzly Research put out a short report drawing a parallel between TuSimple and embattled electric truck start-up Nikola, saying both companies had "shady" founders, several common backers, and questionable technology.

"We've dealt with turmoil this past year, and it's critical that we stabilize operations, regain the trust of our stakeholders and provide the talented team at TuSimple with the support and leadership they deserve," said newly installed CEO Lu on Thursday.

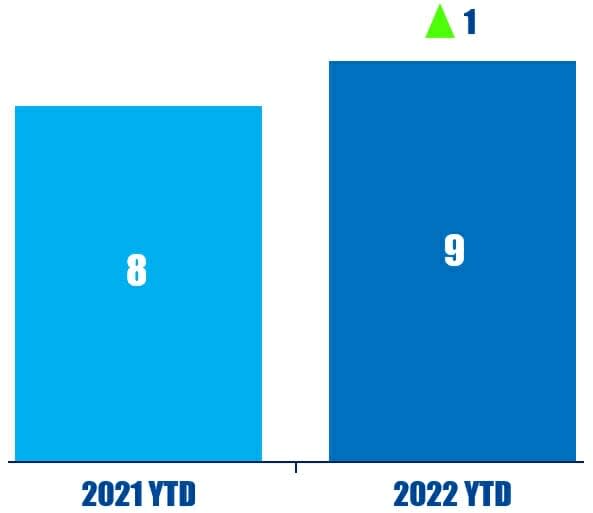

Shorts chart of the week

So far this year (as of November 11, 2022), Hindenburg Research has publicly subjected nine companies to an activist short campaign. That is up from eight in the same period last year.

Source: Insightia | Activist Shorts

Quote Of The Week

This week's quote comes from members of the Investor Advocates for Social Justice who refiled proposals calling on Wells Fargo and Citigroup to enhance reporting related to human rights standards for Indigenous Peoples. Read our reporting here.

“Investor expectations on this issue are increasing, as institutions develop screens against companies with a pattern of violating Indigenous rights.” – Investor Advocates for Social Justice