Recently, I was invited to speak to the undergrad students at the Business-School (Collett School of Business) of the University of Alabama (UAB) at Birmingham. Like most kids of their age, these 20-somethings were trying to figure out a career path after graduation.

And so, after a brief presentation followed by a robust Q&A session, as I was preparing to head back to my room, a few students started peppering me with questions: some questions were about investing, some about investment banking, and others about my career to this point.

Q3 2022 hedge fund letters, conferences and more

One particular student asked a couple of interesting questions that related to portfolio management, and I could tell that he had given them a lot of thought. One of these questions was: “How much cash do you carry in the portfolio?”

This simple question appears to trouble not just individual investors, but also many professional managers. After all, with the markets being down again this year, wouldn’t it make sense to sit on cash and wait out the 1000-days of chaos that started in February 2020? In this brief note, I will tell you how I handle cash within SVN Capital in more detail.

Many “investors” have a short time horizon which leads them to trade more frequently in their portfolios. They may think it prudent to sit on cash, particularly in a year like this one when the stock market has been down throughout.

The trouble with this thinking is that one must be right twice: and I do not know anybody who has consistently mastered the art of selling at the top and buying at the bottom. The other problem with this line of thinking is that sitting on cash and waiting for a correction or pull back, by definition, makes one pessimistic. Here I am reminded of Peter Lynch, who said, “Unless you are a short seller or a poet looking for a wealthy spouse, it never pays to be pessimistic.”

So, what is the right approach?

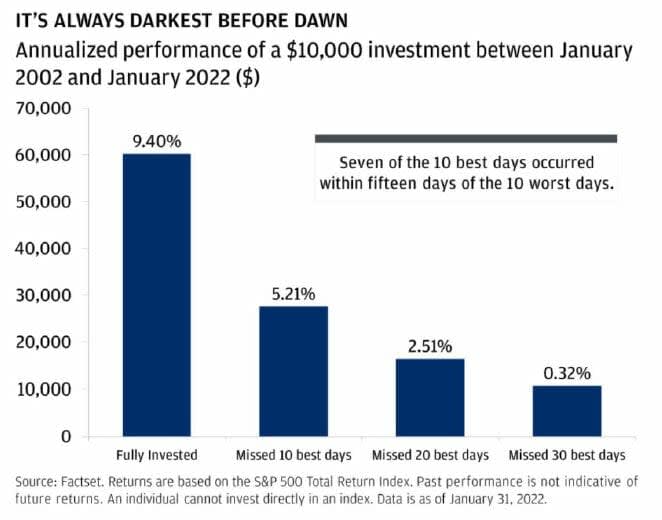

Earlier this year, JP Morgan Wealth Management released the following chart, which I believe answers this question.

Remaining Fully Invested

Over the last 20 years, remaining fully invested in the market resulted in a 9.40% return. But missing 10 of the best days in the market cut the return by almost half. It got progressively worse for missing the 20 best days or 30 best days in the market.

The real punchline from the chart is that “seven of the 10 best days occurred within 15 days of the 10 worst days.” This is worth repeating and pondering. Seven of the 10 best days occurred within 15 days of the 10 worst days. Since nobody is privy to the future, and since businesses produce returns significantly better than cash, we are better off remaining invested.

So, what type of businesses should you be invested in? To answer this, let me refer to Michael Mauboussin’s recent interview of Todd Combs. Todd is one of two managers that Warren Buffett and Charlie Munger hired to manage money alongside Warren within Berkshire Hathaway. Michael is an author and professor at Columbia University. What follows is a bit of that conversation between the two:

Combs recalled that the first question Charlie Munger ever asked him was what percentage of S&P500 businesses would be “better businesses” in five years. Combs believed that it was less than 5% of S&P500 businesses, whereas Munger stated that it was less than 2%.

You can have a great business, but it doesn’t mean it will be better in five years. The rate of change in the world is significant, which makes this exercise difficult; but this is something that Charlie, Warren and Todd think about.

I thought this was a fantastic piece of information about how these great minds think about quality business. I too think there are only a few businesses that can remain high quality over time. Most often, this will be due to their sustainable competitive advantages.

Now, returning to that statement about knowing yourself. At SVN Capital, I am an investor in businesses that not only generate high returns on incremental capital, but also have terrific reinvestment opportunities, the combination of which leads to value creation. Many of them are owner-operated.

Since very few businesses meet all the investment criteria, I remain invested in only a few - 10 to be precise. And I’d like to remain invested in them for a long time - preferably several years. For me, cash, as a result, is what is left after allocating to these quality businesses.

I continue to believe that time in the market is more important than timing the market. So, my approach is to remain fully invested and I currently have approximately 2.0% in cash. Obviously, it is not the only way to manage cash in the portfolio. But for me, with a focus on high-quality businesses and with a time horizon in years, remaining fully invested is what works.