Dear fellow investors,

A 1930 movie made in the mania toward the end of the Roaring Twenties called Happy Days are Here Again started with this opening stanza:

So long sad times

Go long bad times

We are rid of you at last

Howdy gay times

Cloudy gray times

You are now a thing of the past

Q4 2022 hedge fund letters, conferences and more

Anyone who has raised children knows that when sins are punished by parents, the last thing those parents want to see is the bad behaviors repeated in the aftermath. This is exactly what the stock market has done so far in the year 2023. The same patterns we saw in the mania which peaked in late 2021 are showing themselves again.

1. Speculation in the most expensive and aggressive highly-priced growth stocks.

In an article titled “FOMO Options Bets Sweep During Stock Rally,” writers Eric Wallerstein and Gunjan Banerji point out that option traders are “riding this year’s rally en masse, favoring bets on technology stocks to capture quick gains.”

They are buying options in the stocks which fell the most last year and literally ripped the guts out of growth managers. Here are the statistics of the unruly behavior of the children which haven’t been punished enough to learn the lessons in a bear market.

“More than 40 million call-option contracts changed hands in a single day in early February—the highest level on record and nearly topping 2022’s daily average volume for puts and calls combined. That propelled overall activity above 68 million contracts, also a record.”

Happy days are here again

The skies above are clear again

So let’s sing a song of cheer again

Happy days are here again

1. The most aggressive stocks, which got their clocks cleaned last year, seem to have “skies above (that) are clear again” in the first 45 days of this year.

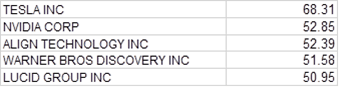

Here is the list of the five best performing stocks in the Nasdaq 100 ETF QQQ:

Four are former glam tech stars of the last five years, so “let’s sing a song of cheer.”

Happy days are here again

Your cares and troubles are gone

There’ll be no more from now on

1. The most aggressive equity managers seem to have the same amount of courage in public that they had during the woogie period from 2015-2021.

It appears that the unruly children have not been spanked enough and from a historical basis, this is indicative of a bear market rally. There were seven rallies of over 10% in the 2000-2003 bear market which crucified tech investors and caused tech to be dead money for ten years.

1. Household equity ownership is nowhere near levels that would indicate a floor for stock prices.

1. While the Federal Reserve Board tightens credit to mitigate inflation, the Federal Government continues to practice massive fiscal stimulus in the ironically named “Inflation Reduction Act.” Can the Federal Reserve Board overcome the massive demand caused by the millennial age households emerging as home buyers, car buyers, child bearers and necessity spenders? Can tight credit overcome the largest deficit spending under two administrations done to get us through the pandemic? Will we have the sickness of persistent inflation the next decade as a byproduct of the pandemic cure?

Happy days are here again

The skies above are clear again

So let’s sing a song of cheer again

Happy times, happy nights

Happy days are here again

Stock market history argues that the next bull market in stocks will emerge when all the sinful behaviors of the last financial euphoria have been cleansed from the system. It will be marked by stock market failure and there will be no urge to recreate the woogie-like euphoria of the prior period.

We believe success in common stock investments will come from companies which benefit from persistent inflation and a relatively strong economy led by 92 million Americans aged 25-45 years old. Is it different this time?

Warm regards,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change.

Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable.

Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security.

Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources.

A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2023 Smead Capital Management, Inc. All rights reserved.

Article by Smead Capital Management