What’s New In Activism – Third Point Backtracks On ESPN

Third Point Partners’ Dan Loeb backtracked on his push for a spinoff of sports broadcaster ESPN after parent Walt Disney rejected the idea.

Over the weekend, Walt Disney CEO Bob Chapek told several media outlets that he had confidence in ESPN’s value within the media group.

Q2 2022 hedge fund letters, conferences and more

A month ago, Loeb said in a letter to Chapek that he planned to push for a string of changes at Disney. The activist argued spinning off ESPN would allow Disney to reduce its $46-billion debt load.

Loeb also called on Disney to fully integrate Hulu - the streaming company part-owned with Comcast - cut costs and add new directors to fill what he called the board's "gaps in talent and experience."

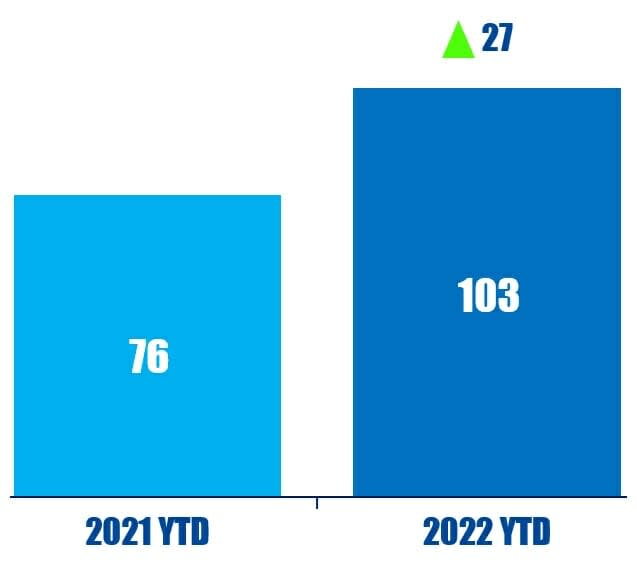

Activism chart of the week

So far this year (as of September 8, 2022), 103 U.S.-based companies have been publicly subjected to a social-related demand. That is compared to 76 in the same period last year.

Source: Insightia |Activism

What’s New In Proxy Voting - BlackRock Defends Policies

BlackRock Inc (NYSE:BLK) defended its policies on climate risk and ESG investing, expressing concern over the politicization of public pension plans, amid attacks by U.S. Republican states over boycotting claims.

In a September 7 letter, BlackRock Senior Managing Director Dalia Blass said the fund manager's decision to participate in ESG initiatives was the result of its efforts to "realize the best long-term financial results consistent with each client's investment guidelines."

Blass addressed an August 4 letter to BlackRock CEO Larry Fink from 19 state attorneys general accusing the fund manager of using "the hard-earned money of our states’ citizens to circumvent the best possible return on investment" in its position on energy investments.

"We are disturbed by the emerging trend of political initiatives that sacrifice pension plans’ access to high-quality investments – and thereby jeopardize pensioners' financial returns," Blass said.

On August 24, Texas Comptroller Glenn Hegar included BlackRock on a list of 10 financial companies that allegedly "boycott energy companies." Blass denied the accusations.

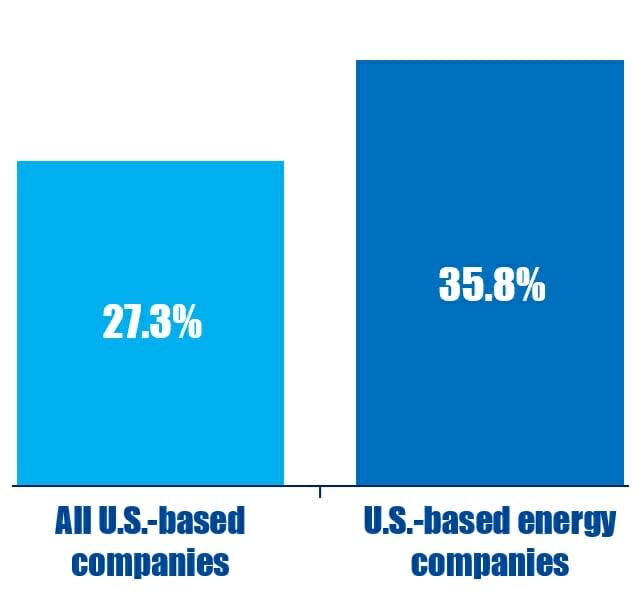

Voting chart of the week

So far this year (as of September 9, 2022), environmental and social shareholder proposals at U.S.-based energy companies have received an average of 35.8% support. That is compared to 27.3% for all U.S. companies.

Source: Insightia |Voting

What’s New In Activist Shorts - Trump's Social Media Difficulties

The blank-check company trying to take Donald Trump's social media company public is facing difficulties getting shareholders to approve an extension of the deal’s deadline.

Two short sellers previously raised doubts about the merger agreement, signed almost a year ago.

On Thursday, Digital World Acquisition Corp (NASDAQ:DWAC) announced that it would extend its life by three months in an effort to obtain backing from shareholders for a 12-month extension of its merger with Trump Media & Technology Group, which operates the former U.S. president's Truth Social app.

The change came after Digital World, a special purpose acquisition company (SPAC) headed by ex-investment banker Patrick Orlando, failed to secure the required 65% shareholder support to extend the deadline to close its merger with the Trump-backed social media company.

Failure to win support for the extension would lead to the vehicle's liquidation and prevent Trump's social media company from accessing the $1.3-billion cash raised by the SPAC to fund the deal.

Shorts chart of the week

So far this year (as of September 9, 2022), 23% of public activist short campaigns have been directly responded to by the company. That is down from 39% in the same period last year.

Source: Insightia | Activist Shorts

Quote Of The Week

This week's quote comes from ClientEarth climate lawyer Maria Petzsch as it backed a complaint from a coalition of environmental groups that accuses multinational metals and minerals company Glencore of producing misleading net-zero statements. Read our coverage here.

“To us the coal giant’s claims to shareholders and the public appears as an elaborate case of smoke and mirrors.” – Maria Petzsch